The “Silent Revolution” in Germany’s Foodservice Industry: What It Means for You

Background: Cracks in a “Stable” Market

Germany’s foodservice market has always seemed “steady.” Even “conservative.”

Europe’s largest economy doesn’t chase trends like Asia. It doesn’t expand chains like crazy like the US. Germans are practical about food. They want value. Flashy marketing doesn’t impress them.

But the last two years? Things changed.

Energy crisis aftershocks linger. Labor shortages went from “problem” to “crisis.” Inflation made consumers tighten their wallets. Meanwhile, new players are rewriting the rules.

I thought this was just post-pandemic adjustment. I was wrong.

This isn’t a cycle. It’s a structural shift.

Analysis: Three Forces Tearing Apart the Old Order

Force One: Labor Crisis Drives Automation

How bad is Germany’s staffing gap? Only 60% of workers who left during COVID came back.

It’s not about wages. Young people simply don’t want these jobs anymore. Irregular hours. Physical strain. Limited career growth. The new generation won’t accept it.

The result?

Automation equipment purchases more than doubled in 18 months. Self-ordering systems. Smart kitchen gear. Robot servers. AI inventory management.

German restaurants are embracing tech. But not by choice.

They’re forced to. They can’t find workers.

This “forced innovation” hits harder than voluntary change. There’s no plan B.

Force Two: Consumer Polarization

German consumers are splitting into two camps.

One side: price-obsessed masses. Inflation cut dining-out frequency. When they do eat out, it’s fast food or budget spots. Aldi and Lidl’s ready-meals are selling like never before.

Other side: experience seekers. Small group. Big spending power. They want unique experiences. Sustainable ingredients. Instagram-worthy moments.

The middle ground? Getting crushed.

“Decent but unremarkable” restaurants are struggling most.

Reminds me of retail ten years ago. Mid-tier department stores collapsed. Survivors were either Walmart-style discounters or luxury brands.

Foodservice is replaying that script.

Force Three: Supply Chain “Nearshoring”

Pandemic and geopolitics taught everyone a lesson. German foodservice procurement logic is shifting.

“Local” and “regional” aren’t just marketing buzzwords anymore. They’re risk management.

More restaurants partner directly with local farms. Equipment makers see rising demand for “small batch, high variety” production. Regional cold chain networks are expanding fast.

Translation: Supply chains are moving from “long and cheap” to “short and controllable.”

So What: What This Means for You

If you’re an equipment manufacturer—

Buying decisions changed. Price and durability used to dominate. Now? “Can it save labor?” comes first.

Equipment that cuts staffing needs will sell—even at 30% premium. But you must quantify the value. “Saves about one person” won’t cut it. “Saves 4.5 hours daily, 18-month payback at German minimum wage” will.

If you’re a food supplier—

Two paths ahead.

Go volume: serve price-sensitive masses. Margins will be razor-thin. Go differentiated: serve premium markets. You’ll need compelling stories—origin, sustainability, craftsmanship.

The danger zone? Stuck in the middle.

If you’re in foodservice—

Time to rethink positioning.

Is your restaurant “too cheap to refuse” or “too unique to skip”? If neither, consider transformation seriously.

Also: tech investment isn’t optional anymore. Even basic reservation and inventory software helps you survive staffing crunches.

Now What: Five Action Items

1. Recalculate your “labor cost sensitivity”

Reclassify your products by “how much labor they save clients.” This might flip your priorities. Features you thought were “nice-to-have” might be your new core selling point.

2. Build a dual-track strategy

Don’t serve everyone with one approach. Mass market and premium need different products, pricing, and messaging. Limited resources? Pick one lane. Commit fully.

3. Invest in quantifiable proof

German buyers are famously rational. They want data. Case studies. ROI calculations. Ditch vague “improves efficiency” claims. Use specific numbers.

4. Watch for nearshoring opportunities

Supply chain restructuring creates openings. Suppliers offering local service, fast response, and small-batch customization gain advantage. Good news for smaller players.

5. Don’t ignore sustainability

German consumers genuinely care about environment. It’s not performance. If your product has sustainability advantages, amplify that message now. But keep it real. Germans spot greenwashing instantly.

Summary: Finding Certainty in Uncertainty

Germany’s foodservice changes look like stacked crises—energy, labor, inflation. Dig deeper: it’s overdue modernization.

For twenty years, German foodservice evolved slower than other developed markets. Now it must compress a decade of change into a few years.

Compressed transformation challenges incumbents. It rewards newcomers.

The real question: Wait for “normal” to return? Or accept this is the new normal?

My take: “Normal” isn’t coming back. Labor shortage is structural. Consumer polarization is long-term. Supply chain restructuring just started.

Stop mourning the past. Start adapting to the future.

Germany’s market trait: once it accepts something new, loyalty runs deep. Relationships and positions built now could pay dividends for a decade.

The window won’t stay open long.

Companies still watching from the sidelines? They might find all the good spots taken when they’re finally ready to move.

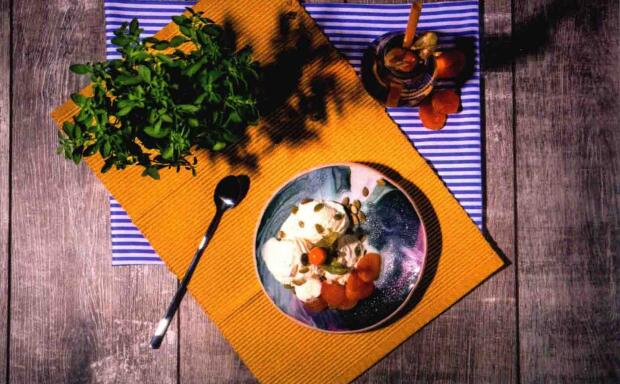

If you have any questions or need to custom dinnerware service, please contact our Email:info@gcporcelain.com for the most thoughtful support!